Keeping your tax registration details up to date in the UAE is crucial for individuals and businesses alike. Are you wondering how to amend taxable person details in the Emirates? Whether you are registered for VAT or Corporate Tax, the Federal Tax Authority (FTA) requires you to notify them of any changes—such as a change in address, trade licence details, or contact information—typically within 20 business days of the change.

Failure to comply can lead to penalties, although a current grace period waives these penalties under certain conditions.

We’re here to explain the processes, documents, and timeframes for making amendments via the FTA’s EmaraTax portal, helping you stay compliant and penalty-free.

What You Can Amend and the Evidence You Need

Below is a handy table summarising common amendments you might need to make, together with the supporting documents typically required:

| Type of Amendment | Required Supporting Documents |

|---|---|

| Business name or trade name change | Updated trade licence (showing the new name) and any official proof of name change (e.g. amended Articles of Association). |

| Change in business ownership (partners/shareholders) | Updated trade licence reflecting new ownership, plus proof of ownership change (e.g. updated Articles of Association, partnership agreement). |

| Change of business address (principal place) | A new lease agreement or property title deed showing the updated address. |

| Update of business activity | A valid trade licence or business licence reflecting the new or additional activity. |

| Trade licence renewal or amendment | Copy of the renewed or amended trade licence (particularly if licence number, company name, or activities have changed). |

| Change in legal entity type (e.g. from sole proprietorship to LLC) | Legal documentation proving the change (updated partnership agreement, amended Articles of Association, etc.). |

| New authorised signatory (or removing one) | For a new signatory: identification documents (passport, Emirates ID) and a board resolution or authorisation letter. For removal: evidence of the removal (letter or resolution). |

| Update to contact details (e-mail or phone) | Generally no special document required. Ensure correct new contact details are submitted and accessible. |

| Additional branch(es) for VAT | A trade licence for the new branch. |

| Other not listed | Any relevant supporting document confirming the change. Examples: official bank letters, government or licensing authority confirmations, etc. |

Note: The FTA accepts various file formats (PDF, JPG, PNG, Word, Excel) up to a certain size (often around 5 MB). Ensure the details in your documents exactly match what you input in EmaraTax.

How to Amend VAT Details in the EmaraTax Portal

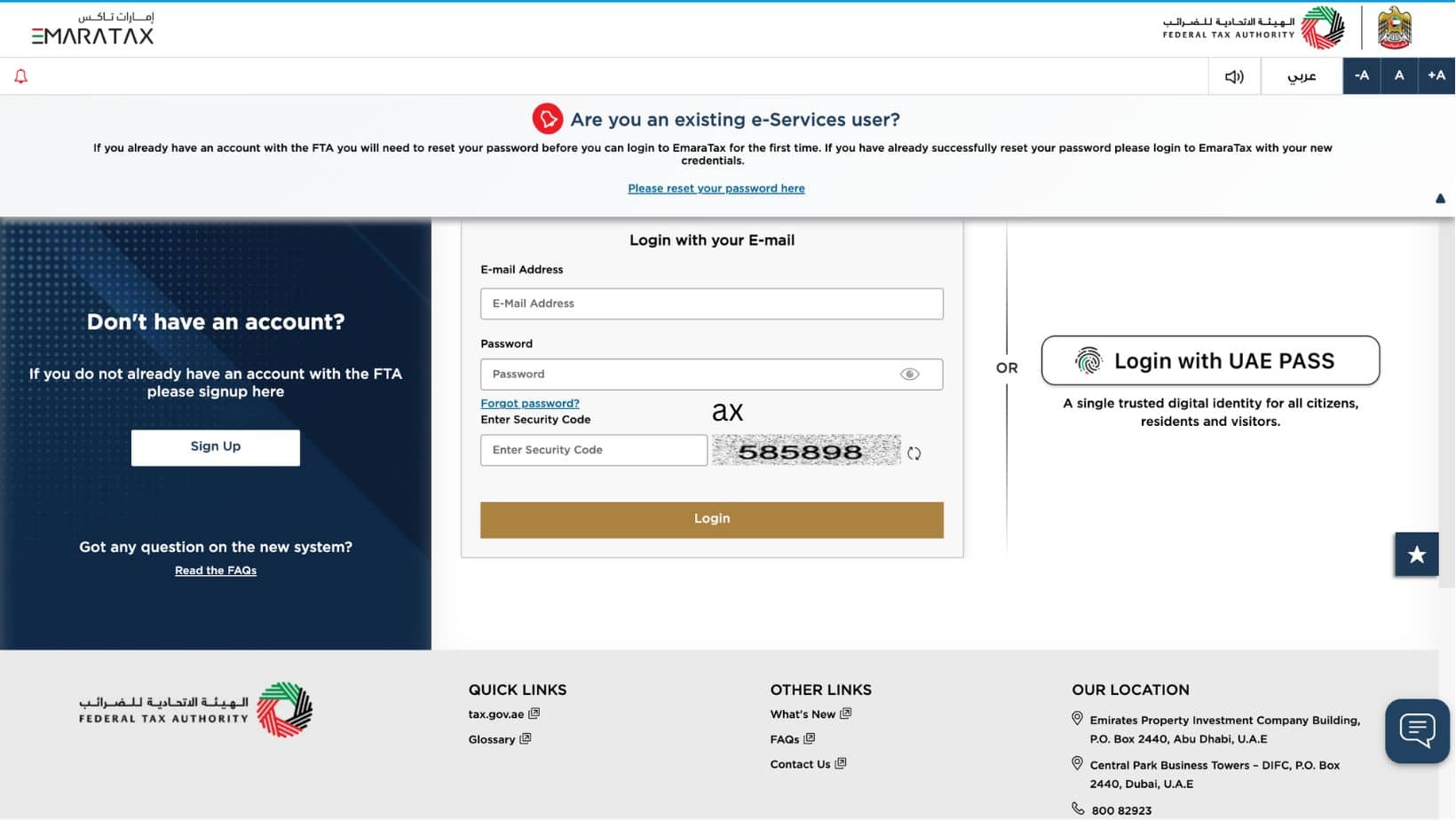

Access Your FTA Account

Log in to the FTA’s EmaraTax portal using your email and password, or via UAE Pass. Once logged in, your main dashboard will appear.

Go to Your Taxable Person Dashboard

Click on your business or individual name. If you have multiple tax profiles, choose the relevant one to open that dashboard. You will see tiles for each tax (VAT, Corporate Tax, etc.).

Select the VAT Amendment Service

In the VAT section, look for an “Amendment” option (sometimes in an Actions or ⋯ menu). Choose this to start an amendment request.

Review Guidelines and Begin

The FTA displays brief instructions about what information and documents you need. Confirm you have these ready, then proceed to the form, where your existing details will appear pre-filled.

Enable Editing Where Needed

The form is usually divided into different sections (business information, contact details, bank details, etc.). Each section will be “locked” until you click “Enable Editing.” Make changes only in the sections that need updating.

Upload Supporting Documents

Provide proof of each change by uploading the relevant files. For example, if your trade name changed, attach the updated trade licence and name-change documents.

Save Draft or Submit

If you need time to gather more documents, you can save your application as a draft and return later. Once satisfied, click “Submit.” The system will display a reference number for your amendment request.

Await Approval

Your application status will be “In Review.” Most are processed within 20 business days, although you may receive an email sooner. If the FTA needs additional information, you’ll get a notification to supply it.

How to Amend Corporate Tax Details in EmaraTax

With the introduction of Corporate Tax, many businesses are updating initial information or registering for the first time. The amendment process is almost identical to VAT, though the Corporate Tax portal sections may differ slightly:

Log In and Open Your Corporate Tax Account

From your EmaraTax dashboard, select the Corporate Tax tile. If you have multiple registrations (e.g., for different entities), pick the one you need to amend.

Choose the Amendment Option

As with VAT, there will be an “Amendment” button or menu item. Click it to begin the Corporate Tax amendment process.

Enable Editing in Relevant Sections

Key sections might include: Entity Details (business name, trade licence), Ownership/Shareholders, Authorised Signatories, and so on. Only edit the sections needing changes.

Attach Relevant Documents

If you are changing legal form, for example, attach your updated Memorandum of Association or any official proof of the change.

Check Everything and Submit

Once complete, review the form carefully, tick the declaration, and submit. You’ll receive a new reference number and an email confirmation. Wait for the FTA’s decision. Upon approval, you can download an updated Corporate Tax Registration Certificate if details like business name or address were changed.

Tracking Your Amendment and Potential Next Steps

- Status Updates: EmaraTax will show statuses such as “In Review,” “Awaiting Information,” “Approved,” or “Rejected.” You can’t file another amendment for the same tax type until the current one is finalised.

- Requests for More Info: If the FTA needs clarifications, you’ll receive an email explaining what is missing or unclear. Provide the requested documents and resubmit promptly.

- Approval or Rejection: Once approved, you’ll see an “Approved” status and can download updated certificates for VAT or Corporate Tax. If rejected, the portal will show a “Rejected” status, and you can resubmit a fresh amendment request after fixing the issues.

Compliance Tips and the 2024–2025 Grace Period

- 20-Day Rule: UAE law states that any change in your registered details should be reported to the FTA within 20 business days.

- Penalties: Historically, failure to update details on time led to significant fines (often AED 5,000 for the first offence, and more thereafter). However, Cabinet Decision No. 75 of 2023 has introduced updated penalties, and there is a special grace period in place.

- Grace Period for Amendments (1 January 2024 – 31 March 2025): During this window, you can amend your tax details without incurring administrative penalties for late updates. Any penalties incurred for late changes during this period will be waived or refunded.

- Be Proactive: Even with a grace period, keep your data correct to avoid complications when filing returns or claiming refunds. After March 2025, normal rules resume—so it’s wise to get everything in order well before then.

Stay Compliant With Your Tax

Amending taxable person details in the UAE might seem daunting at first, but the FTA’s EmaraTax portal provides a user-friendly interface to update essential data for both VAT and Corporate Tax. By understanding what changes are allowed, preparing the right supporting documents, and following the application prompts carefully, you can keep your business fully compliant and avoid unwanted fines.

Use the current grace period wisely if you’ve missed any updates. Once it ends, fines will apply again. As always, consult the official FTA website for the latest instructions or seek expert advice if you have a complex situation.

Staying on top of your registrations is the key to smooth tax operations and peace of mind in the UAE. Still Need Help? Reach out to Virtuzone today!